Ever wonder how borrowers on average incomes manage to borrow millions of dollars? You may be doing the math from the sections above and thinking the numbers don’t match up. If lenders apply such large buffers to mortgage debt, how does a property investor who accumulates more and more debt continue to borrow?

In this blog, we use the knowledge from dissecting individual lender calculators across the market to ‘unlock’ borrowing capacity and build a portfolio. You can use this knowledge to unlock borrowing capacity in dynamic situations involving multiple loan applications over time.

This is done by carefully structuring your loans and using different lending institutions over time to maximise your borrowing capacity. At the end of the day, the section is about how property investors go from one loan application to many!

Whether you are on your first investment or your tenth, lenders will use their serviceability calculators, calculate your income and assessed expenses, and will lend to you based on what ‘surplus’ is available. However, these rules produce different results with different lenders. Property investors can take advantage of differences between lender calculators to build larger property investment portfolios.

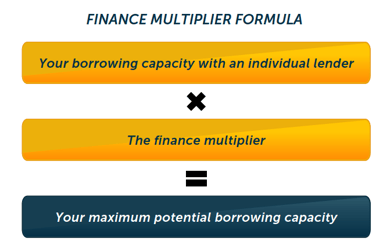

By using the unique differences in lender calculators to your advantage, you can ‘swap’ lenders as you grow your portfolio in a structured way to expand your borrowing capacity. Property investors can grow a larger portfolio by using a pool of lenders than by having all their loans with one individual lender. In fact, property investors can borrow a ‘multiple’ of their borrowing power with an individual lender. We call this the ‘finance multiplier’.

In today’s lending environment, this finance multiplier is over 100%! That is, by correctly structuring their finances and diversifying their lenders over time, property investors can borrow over double what they could have otherwise.

To unpack how this works, firstly, let’s examine the unique characteristics of property investors and how this feeds through to individual lender serviceability calculators:

- Rental income forms a larger proportion of their income. Property investors invest to earn rental income (and capital gain). As they accumulate properties, their rental income grows.

- Investment mortgage debt expenses are higher than most other borrowers. Property investors rely on lenders to finance their portfolios. As their investment portfolio grows, so too does their investment debt. Over time, this quickly becomes a property investors largest ‘expense’ in their serviceability calculations.

Now, rental income is treated consistently between lenders. However, investment mortgage debt expenses are treated drastically different by different lender calculators. This means that as property investors grow their portfolios, there is a greater divergence between what individual lenders will allow you to borrow.

Over time, property investors continue to accumulate more and more mortgage debt. Lenders apply larger and larger buffers to these debts.

This means the ‘assessed’ expenses in serviceability calculators continue to rise with each individual investment purchase more than the rental income that is created. The net effect is lenders will lend less and less to you as you grow your investment portfolio. Hence in the above chart, almost all lender lines are downward sloping – they lend less and less as your portfolio size grows.

How do property investors diversify their lenders to borrow more?

For property investors seeking to maximise their borrowing capacity, it makes sense to begin your investing journey with a suitable foundation lender, that offers you flexibility to revalue and easily conduct equity releases. The ability to release equity is an increasing powerful tool for property investors as their portfolio grows. It is also best to ensure that lenders with an ‘aggressive serviceability’ calculators are not used early, as they are more valuable when you leave them until you really need the additional servicing – generally at later stage of your investing journey.

Once your borrowing capacity is ‘soaked up’ with these foundational lenders and they are no longer willing to lend to you, property investors can swap to an aggressive lender and continue to accumulate debt. This allows you to ‘multiply’ your individual serviceability to produce a greater overall borrowing capacity.

The aggressive serviceability calculators add smaller ‘loadings’ to property investors existing debt obligations. That means assessed expenses are lower with these calculators and therefore they have a higher net surplus to leverage. This results in a greater borrowing capacity.

Therefore, there will come a stage in a property investors journey where most middle/conservative tier lenders are no longer willing to lend to you. At this point, the aggressive calculators will continue to produce positive borrowing capacities, thereby expanding a property investors ability to borrow.

COMMENTS